McClain: The IRS Needs to be Held Accountable for Dysfunction and Poor Performance

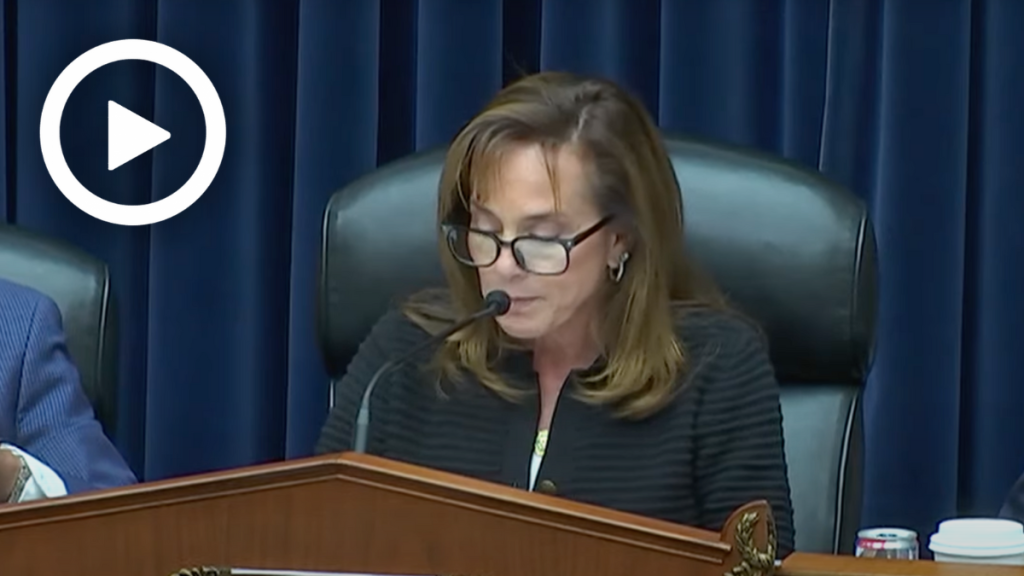

WASHINGTON—Subcommittee on Health Care and Financial Services Chairwoman Lisa McClain (R-Mich.) today opened a joint subcommittee hearing titled “Oversight of the Internal Revenue Service” by warning how while the IRS struggles to complete its basic job and taxpayer services, congressional Democrats’ Inflation Reduction Act doled out $80 billion to the IRS to hire more agents and increase audits on all Americans. Chair McClain calls for accountability for the IRS’s poor performance, delays, and lack of security.

Below are Subcommittee Chairwoman McClain’s remarks as prepared for delivery.

The IRS has been plagued with dysfunction for decades.

The dysfunction is across the board. From data breaches, leaks, and identity theft to slow audits, backlogs, and atrocious customer service.

Despite years of congressional oversight and government watchdog warnings, not much has changed.

My colleagues on the other side of the aisle believe that more money and more power is the solution.

In last year’s falsely named “Inflation Reduction Act,” congressional Democrats dumped $80 billion into the IRS.

With this influx of cash, the IRS plans to ramp up audits on ALL Americans.

The IRS needs stronger leadership – not more money or more audits.

The IRS needs to invest in highly skilled experts, not simply hire more employees.

The IRS needs to invest in QUALITY, not QUANTITY.

Put simply, the IRS needs to do its job.

If a private business did what the IRS does on a daily basis, it would quickly go out of business.

If a private business repeatedly left you on hold for hours at a time or didn’t answer the phone at all, it would go out of business.

If a private business repeatedly left sensitive tax information unsecured, or lost it entirely, it would face criminal penalties AND go out of business.

But since the government is involved, there’s no accountability for poor performance.

Why do we accept this?

Hardworking Americans accept this because they follow the law and they know they face consequences, like penalties and fines, if they don’t. If we make a mistake on our tax return, we pay.

In contrast, when the IRS makes a mistake after mistake, there are no consequences.

This shouldn’t be acceptable. Ever.

Instead of doing its job, the IRS is struggling to complete its basic job functions.

Instead of processing tax returns in a timely manner, Americans are waiting months, and sometimes years, for money that is rightly theirs.

Instead of serving taxpayers, the IRS can’t do something as simple as answering the phone.

Instead of being trustworthy, the IRS carelessly leaves your sensitive information unsecure and vulnerable to leaks, fraud, and identity theft.

Frankly, the IRS is the perfect example of bureaucratic failure.

And there has not been sufficient accountability for it.

As we talk about these issues today, we need to remember that these are real problems that impact real people.

Since I entered Congress, countless constituents have approached my office asking for help with IRS issues.

I have constituents who filed their returns on time this April and have yet to receive their refund.

When they seek help from the IRS, they can’t get ahold of anyone on the phone to get an update on their return status.

Often, they wait hours to reach a customer service representative only to get a courtesy disconnect due to an overloaded switchboard.

I have constituents who are business owners that have outstanding applications for the Employee Retention Tax Credit.

One of these cases has been pending since February. These wait times are untenable for small businesses.

We are here this afternoon to demand answers and accountability on behalf of the American people.

Commissioner Werfel, thank you for being here before the Subcommittees today. I am looking forward to a fruitful discussion.