Comer: ESG is Just Window Dressing for Liberal Activism and Far-left Ideology

The Biden Administration is gambling with Americans’ retirements to fund its own political agenda.

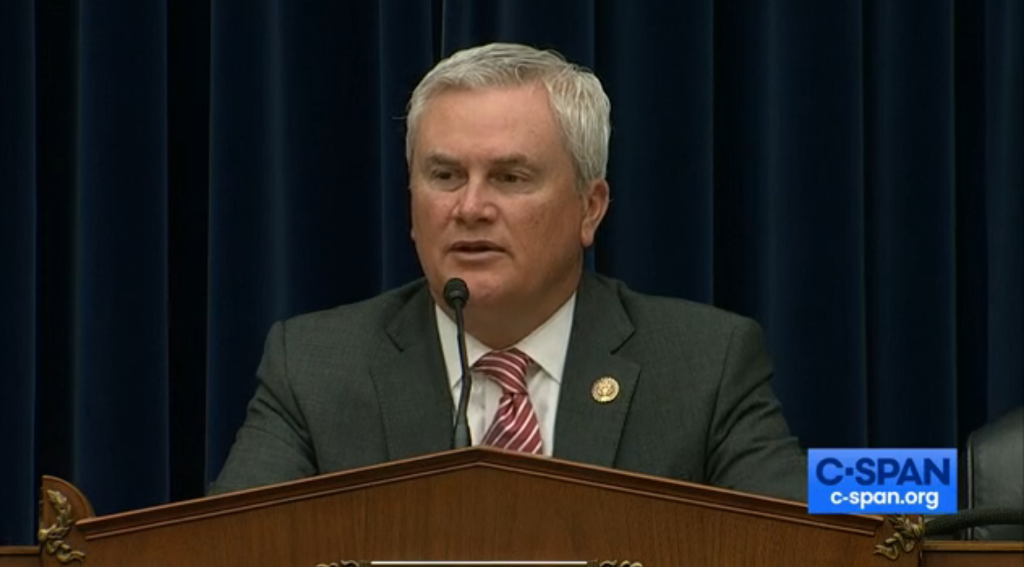

WASHINGTON – Today, House Committee on Oversight and Accountability Chairman James Comer (R-Ky.) delivered opening remarks at a full committee hearing titled “ESG Part I: An Examination of Environmental, Social, and Governance Practices with Attorneys General.” In his opening statement, Chairman Comer emphasized that asset managers and activist shareholders are partnering with liberal advocacy groups to push ESG priorities and a radical political agenda with Americans’ money. He stressed that ESG commitments are often at odds with their clients’ best interests, occur without their clients’ knowledge, and used to force businesses to comply to a far-left ideology. In addition, he highlighted the Biden Administration’s pursuit to advance ESG priorities over the economic, energy, and national security needs of the United States. He concluded that the Committee would continue to expose and investigate harmful ESG practices and hold unelected bureaucrats accountable for pushing their interests on the American people.

Below are Chairman Comer’s remarks as prepared for delivery.

Welcome to the Committee on Oversight and Accountability’s first hearing on the Environmental, Social, and Governance agenda, also known as ESG.

Americans should be free to invest their own money in any legal investment strategy they choose.

This freedom does not exist when asset managers use their clients’ funds to push ESG instead of client returns.

And let’s not kid ourselves. ESG is just window dressing for liberal activism and radical far-left ideology.

Because the Left are not big fans of diverse thought or individual freedom, they are using the “feel good” language of ESG to force compliance to their ideology.

That’s why I am concerned that asset managers and activist shareholders are pushing a political agenda with their clients’ money, agreeing to ESG pledges pushed by global advocacy groups.

These ESG pledges and commitments are often at odds with their clients’ best interests and happen without their clients’ knowledge.

Asset managers control an estimated $126 trillion dollars. That’s Trillion with a “T”, and almost 30 percent of all global financial assets.

That’s a lot of money being manipulated to push a leftist ideology.

Even beyond the assets controlled by asset managers, ESG activists have infiltrated the broader market by influencing just two proxy advisory firms who together control more than 90 percent of the market.

This is a coordinated effort by unelected shadow organizations to force their policies on U.S. taxpayers, investors, and retirees.

And instead of providing Americans with the financial protections they’re due, regulators under the Biden Administration are actively encouraging this political takeover of the American financial system.

President Biden dealt a heavy blow to workers and retirees when he used his first veto to kill a bill that reinforces fund managers’ fiduciary duty to maximize returns on pensions instead of focusing on ESG efforts.

When President Biden vetoed this bipartisan bill, Senator Manchin said “This Administration continues to prioritize their radical policy agenda over the economic, energy and national security needs of our country, and it is absolutely infuriating.”

Senator Manchin is right.

No administration should be able to gamble with Americans’ retirements to fund its own political agenda in the private market.

We must expose and investigate the propriety and legality of this coordinated effort.

In today’s heated political environment, it’s impossible to avoid the ever-expanding web of issues people call ESG.

Whether it’s climate change, abortion, guns, DEI initiatives, or energy independence: the passions run deep.

Our country is based on a system of laws.

Issues of policy should be decided by elected officials accountable to voters.

I am concerned about the well-coordinated campaign to push ESG policies through markets and bureaucratic action, even though those policy goals do not appeal to voters and have not been decided by elected officials.

They are trying to achieve through intimidation and coercion what they cannot achieve at the ballot box.

This issue isn’t theoretical. It is very real for any American family planning and saving for their retirement.

Trillions of dollars in retirement plan assets are at stake.

Obviously, maximizing the return on investment within a retirement account should be the primary factor asset managers focus on for their clients.

The ESG agenda prioritizes leftist ideology over the growth of retirees’ investments.

This is an injustice to those who shoulder the burden for their retirement savings.

Even the slightest reduction in returns from chasing social policy instead of value can have long term impacts on Americans’ retirement savings and ability to retire to spend quality time with their families.

Today’s hearing is specifically focused on concerns Attorneys General have with ESG policies pushed by left-wing activists on the asset management industry and the potential harm for investors and retirees.

But today will not be the end of the Committee’s work.

Asset managers should understand that they are stewards of money that is not theirs, and their failure to act in the best interests of their clients is a dereliction of duty.

Proxy advisors should understand that they cannot intimidate and coerce companies to implement ESG policies without scrutiny.

While this is the first official hearing in what will be a series of oversight actions by this Committee to explore ESG, we’ve already held several hearings to investigate related issues, including misguided energy policy and progressivism in the military.

We must also continue our oversight of the Biden Administration’s government-wide efforts by unelected bureaucrats to dictate to the American people what they are allowed to say, spend their money on, or do with their hard-earned savings.

Whether it’s the SEC and Federal Reserve; the EPA and Department of Energy; the Pentagon; the State Department, know this: we are watching.