McClain: SF Fed Failed to Oversee Silicon Valley Bank Despite Clear Warning Signs

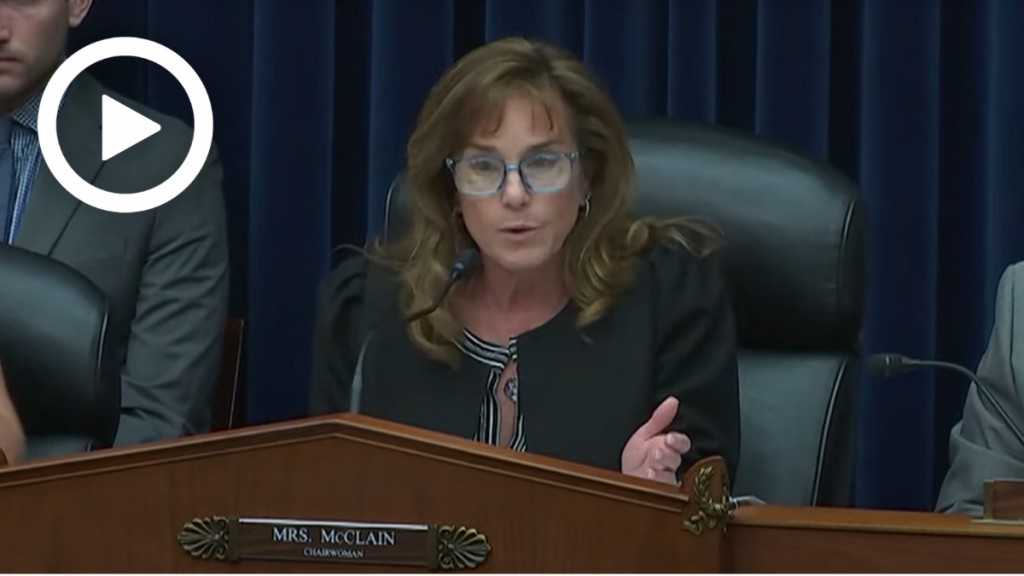

WASHINGTON—Subcommittee on Health Care and Financial Services Chairwoman Lisa McClain (R-Mich.) today opened a hearing titled “A Failure of Supervision: Bank Failures and the San Francisco Federal Reserve” by emphasizing that the San Francisco Federal Reserve failed to provide regulatory supervision and ignored obvious warning signs of a bank run at the Silicon Valley Bank.

Below are Subcommittee Chairwoman McClain’s remarks as prepared:

Banks fail: that is a fact.

But on March 10, Silicon Valley Bank failed nearly overnight.

The speed that it failed raised immediate concerns not only of poor management at the bank, but of a failure of oversight.

Evidence that has surfaced since has shown just that.

Sure, there was incompetence at the top of the bank.

Management, the Board: they all failed.

But the people we have entrusted and empowered to protect the taxpayer and our financial system had as much to do with Silicon Valley Bank’s failure as the bankers themselves.

Even the Federal Reserve has publicly taken some blame.

In my first few years in Washington, one thing has become clear—government agencies aren’t good at taking accountability for their failures.

When crises and failures happen, there’s always a lot more to the story.

Silicon Valley Bank was the second largest bank failure in U.S. history, so you might expect the causes were complicated.

But in fact, it was one of the least complex bank failures in history.

The bank was invested in some of the safest securities available: US treasuries and agency securities.

The credit risk was minimal.

The only real risk to these securities is high inflation rates.

Then came the rampant inflation brought on by President Biden’s unnecessary spending injecting trillions into an economy already flush with cash.

In response, the Fed spent months tightening to try to extinguish the rampant inflation.

Instead of mitigating the risk of rising inflation by hedging with other financial tools, Silicon Valley Bank did nothing despite knowing the risks.

Nor were they forced to hedge by regulators.

Despite knowing that most of Silicon Valley Bank’s deposits were in excess of the $250,000 insured deposit limit.

Anyone could see the ingredients for a run on the bank were in place.

Regulators should have seen it coming from a mile away.

The combination of an unstable deposit base and a plummeting bond portfolio contributed to the evaporation of the $212 billion bank nearly overnight.

All of this raises serious questions:

Who was overseeing this bank?

What were they focused on instead of risk management?

And why didn’t they intervene?

Did regulators get complacent and buy into the political narrative that Dodd Frank solved all problems?

Were the regulators communicating clearly with bank management on matters that needed addressing?

Or did regulators flood management with process questions instead of focusing on the fundamental issues that mattered?

Today we are going to try to get some answers on where and why regulatory supervision failed.

But we are not stopping there. We are taking a deep look into the steps the regulators took in recent years and asking questions.

Did the Fed use all the tools available to prevent the failure?

Did the Federal Deposit Insurance Corporation, or FDIC have the proper early warning systems in place?

Has the FDIC been transparent about the process around the seizure of Silicon Valley Bank or is there more to the story?

Did the Fed’s postmortem evaluation pursue a political objective or was it truly a self-reflective exercise to uncover the truth?

This Committee is named Oversight and Accountability and that is exactly what we are pursuing. If government officials are to blame and have not been forthcoming, we will hold them accountable.