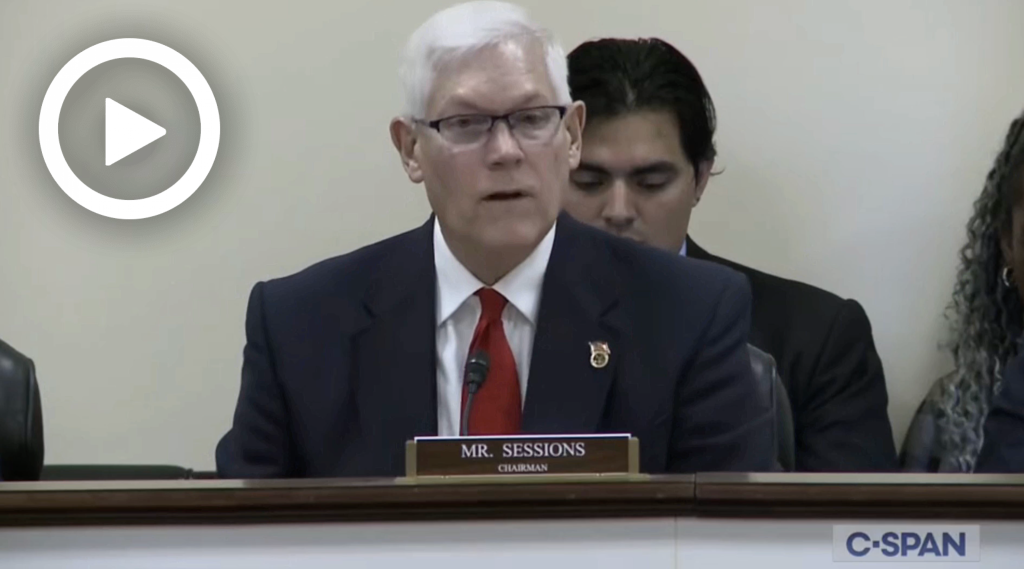

Sessions Opens First Subcommittee Hearing on Fraud in Government Payment Systems

WASHINGTON—Subcommittee on Government Operations Chairman Pete Sessions (R-Texas) delivered opening remarks at the Subcommittee’s first hearing of the 119th Congress titled “Shifting Gears: Moving from Recovery to Prevention of Improper Payments and Fraud.” Subcommittee Chairman Sessions began his remarks by emphasizing that preventing fraudulent and improper payments will continue to be an important subject of investigation and scrutiny during the 119th Congress. He explained that during the 118th Congress, the Subcommittee identified several areas for improvement in federal payment systems, many of which remain unaddressed by federal agencies. Notably, Ranking Member Mfume has consistently joined Subcommittee Chairman Sessions’s work to resolve these issues. A continued bipartisan effort to more effectively combat fraud and improper payments through the expanded use of personal data is essential to the Subcommittee’s work this Congress. To conclude his remarks, Subcommittee Chairman Sessions emphasized that payment systems across all levels of government must be prepared to respond more effectively in the event of a future crisis.

Below are Subcommittee Chairman Sessions’s remarks as prepared for delivery.

Good morning, ladies and gentlemen, and welcome to our first hearing of the 119th Congress.

It is good to once again be seated next to my friend and colleague, the Gentleman from Maryland, the Ranking Member Mr. Mfume.

I also welcome those Members on both sides of the aisle that are new to our subcommittee.

Mr. Mfume, I intend to continue our practice of working together in a professional, fair manner for the benefit of the American people.

As such, this Subcommittee will continue the work we began last Congress into security clearances, the DoD audit, and our topic today: preventing fraud and improper payments in federal programs.

This Subcommittee’s first hearing in the 118th Congress was on COVID-related waste, fraud, and abuse. Indeed, it was the Full Committee’s first hearing as well.

And here, at the beginning of the 119th Congress, we return to the subject because there is much to be done to ensure we do not suffer the same type of losses—estimated between half a trillion and a trillion dollars—ever again.

But it is not just during emergencies like COVID that fraud is a problem. GAO estimates federal agencies lose hundreds of millions of dollars every year in fraudulent payments related to routine federal government programs.

Over the past two years, we have heard a number of suggestions to improve our program integrity capabilities, and more will be discussed today. But I must admit, I expected the federal agencies to be further along.

In the previous Congress, this Subcommittee, both Democrats and Republicans, worked to develop a method to track agency progress in preventing fraud and improper payments.

However, after many months of this effort, it became clear that existing reporting mechanisms and data sources that agencies provided were incapable of providing a fair and accurate measure of an agency’s posture.

As a result, in the fall of last year, I directed our staffs to convene a series of roundtables with the IG community, GAO, OMB, and other stakeholders to identify, as clearly as possible, the reasons agencies were not better able to prevent fraud and improper payments.

After several such roundtables at the staff level, Ranking Member Mfume and I were briefed on the resulting recommendations—which were simple.

Ranking Member Mfume and I requested that GAO conduct a series of reviews with agencies to determine the root causes of poor program integrity.

The roundtable participants recommended—and the Ranking Member and I accepted—that GAO focus first on those agencies and programs that presented the greatest risk of potential loss.

We eagerly await their feedback on this first prioritized phase.

We hope through these discussions we will develop a clear understanding of laws, policies, processes, information technology system deficiencies, and other matters that must be addressed.

We know that longstanding efforts to prevent improper payments are not working sufficiently. It is not enough to create new or different iterations of the old way of doing business.

To that end, I have asked OMB to compile a list of reports and other requirements that either serve no purpose at all, are ignored, or are otherwise nothing more than a waste of resources so we can get rid of these and make way for new methods to combat increasingly sophisticated fraudsters.

We know better identity verification is vital to reduce identity theft—a leading fraud tactic.

And we also know that data sharing—or lack thereof—is perhaps the key issue to address.

People may be familiar with the challenges of the Death Master File—which allows us to avoid sending benefits to the deceased—or the restrictions on access to tax data.

But the bottom line is that we need to know what data agencies need, who has that data—be it another federal agency, a state, or some other entity—and whether they have the ability to access it. And if not, why not?

In order better prevent fraud and improper payments, expanded access to and use of personal data will be necessary. We must weigh privacy concerns against the overwhelming need to verify payments.

And we cannot forget about the key role played by states and localities. They implement significant federal programs such as Unemployment Insurance, Temporary Assistance for Needy Families, and the Supplemental Nutrition Assistance Program.

It will have diminished effect if we ensure federal agencies run a tight ship while not assessing state and local programs and how we can partner with them to stop the flow of improper payments.

The last point I will mention is that we must understand the ability of governments at all levels to scale in the event of a future crisis.

Will information technology systems tested with exponential surges in demand—such as we saw in COVID—be up to the task?

Can agencies quickly add personnel to deal with sharp surges in demand?

Those are questions we need to be asking now—and we need to have confidence by stress testing our capabilities to ensure they are sound.

I thank our witnesses for their testimony, and I now yield to the distinguished ranking member, Mr. Mfume for his opening remarks.

###